Turning the Ground Beneath Us Into Growth: Why Land Tokenization Could Be India’s Most Powerful Unlock

India sits on over $3 trillion in land wealth that is mostly locked and underused. Could tokenization turn land into trust, liquidity, and growth for millions? Here's why it matters now.

A couple of weeks back Nandan Nilekani delivered a characteristically sweeping and deeply energizing talk titled ‘The Great Unlock: India in 2035.’1 It wasn’t your usual macro sermon or policy wishlist. Instead it laid out a credible and actionable blueprint for moving India from a 6% to 8% growth trajectory powered by four distinct levers: technology, capital, entrepreneurship, and formalization.

Much of what he said reminded you of a familiar story: how Aadhaar, UPI, DigiLocker, and Account Aggregator became the plumbing for a DPI-led inclusion story. How capital cycles in India now run from angel to IPO. How startups are no longer a metro phenomenon but drivers for Bharat. But tucked into the ‘capital unlock’ section was a quietly radical idea. Its one idea that we feel deserves a bigger spotlight.

What if the most transformative financial innovation in the next decade wasn’t about money or financial markets at all… but about land? This sets the tone for the underexplored frontier of land tokenization.

The Weight of Dead Capital

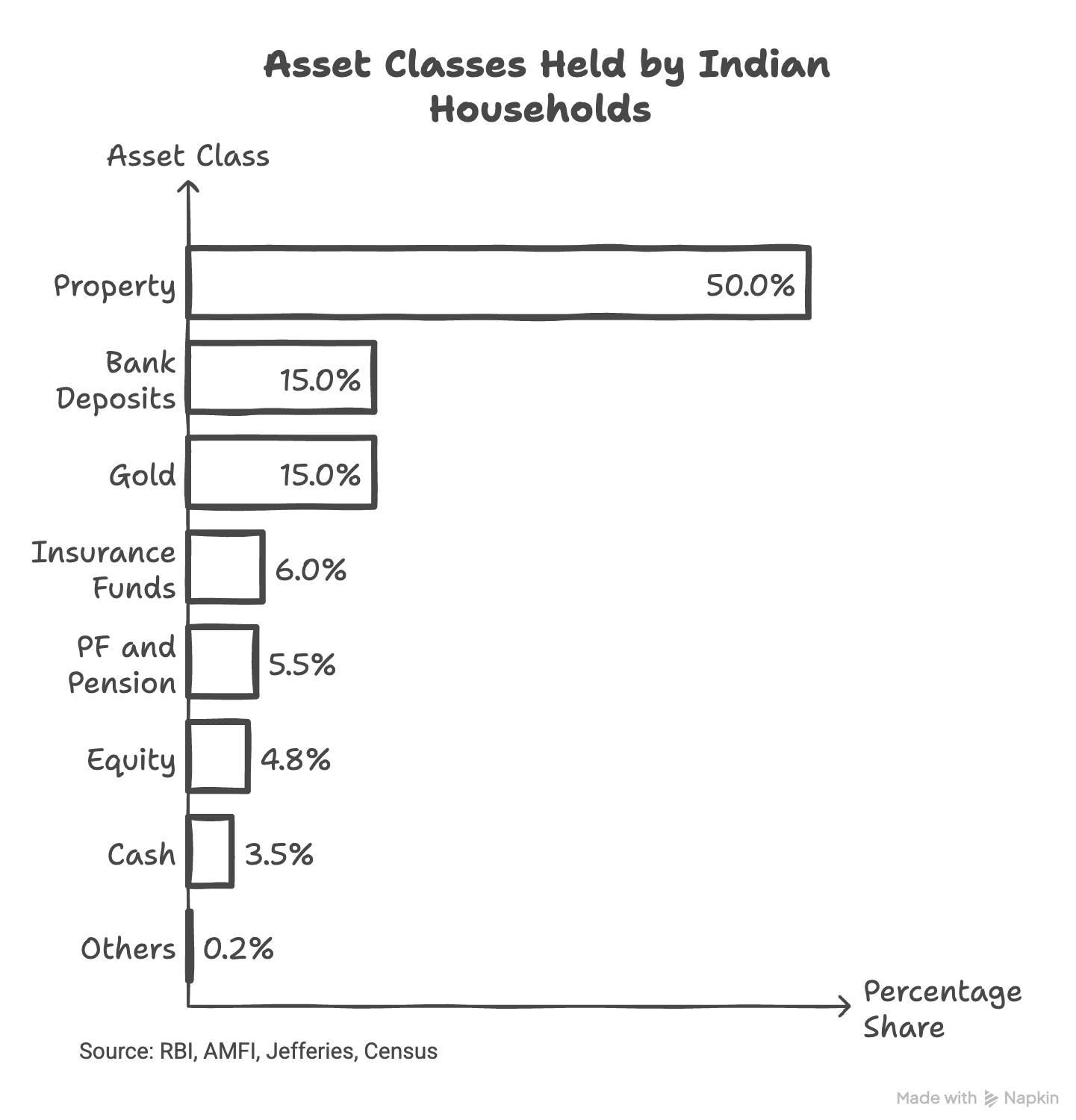

The presentation pointed out a striking fact. Over half of India’s household wealth is held in land! Yet for most people, that land is dead capital. It is wealth that can not be easily leveraged, transferred or monetized.

You can’t borrow against it easily. You can’t prove clear title in many cases. And even when you can, the process is so fragmented across local registries and legacy systems that the transaction cost of using land as an asset is often prohibitively high. In a country where most small business owners can’t access credit as they don’t have collateral, land remains our largest trapped asset.

At the heart of these inefficiencies also lies significant trust gaps. People don’t trust the records, institutions don’t trust the documentation and systems don’t trust each other. About 25% of all cases decided by the Supreme Court involve land disputes. Did you know that nearly 2 in 3 of all civil cases in India are related to land/property disputes? 2 This mistrust keeps land out of potential productive uses.

In India, land has long been more than just a physical asset. It symbolizes wealth, stability and heritage. Owning land is often seen as a symbol of success and security. It is deeply rooted in cultural traditions and familial legacies. This cultural significance has made real estate one of the most preferred forms of investment, with over 59% of Indians favoring it as their asset class of choice3. Despite this status, a significant portion of land in India remains economically inactive. Issues such as unclear titles, fragmented ownership records, and cumbersome legal processes render land assets illiquid and challenging to utilize for economic purposes.

What Other Countries are doing about Tokenizing Land

Globally, land and real estate tokenization have demonstrated the potential to democratize access to property investments and enhance liquidity. Just recently the Dubai Land Department (DLD) became the first property registrar in the Middle East to launch a full-fledged Real Estate Tokenization Project. Developed in partnership with Dubai’s Virtual Assets Regulatory Authority and Dubai Future Foundation, the project tokenizes property title deeds, directly embedding real estate ownership into programmable digital tokens. 4

Singapore has established a progressive regulatory framework, encouraging innovation in digital assets, including real estate tokenization. Platforms like Propine and SmartKarma operate within this favorable environment5. Malta, known as the ‘Blockchain Island’ offers a supportive ecosystem for tokenized real estate ventures, with platforms like Tokenomica facilitating fractional ownership6. Even China is exploring tokenization despite regulatory challenges, with cities like Shanghai and Beijing witnessing the emergence of new platforms.

India is beginning to explore the potential of land tokenization. The Andhra Pradesh government is exploring blockchain technology, including tokenization for land record management, to increase transparency and reduce disputes. Additionally, GIFT City is preparing to launch its first regulated tokenization platform for real-world assets7, signaling a progressive step towards integrating blockchain solutions in the financial sector.

Can tokenization act as a trust layer?

So what does tokenization do… and how does it build trust where little existed before?

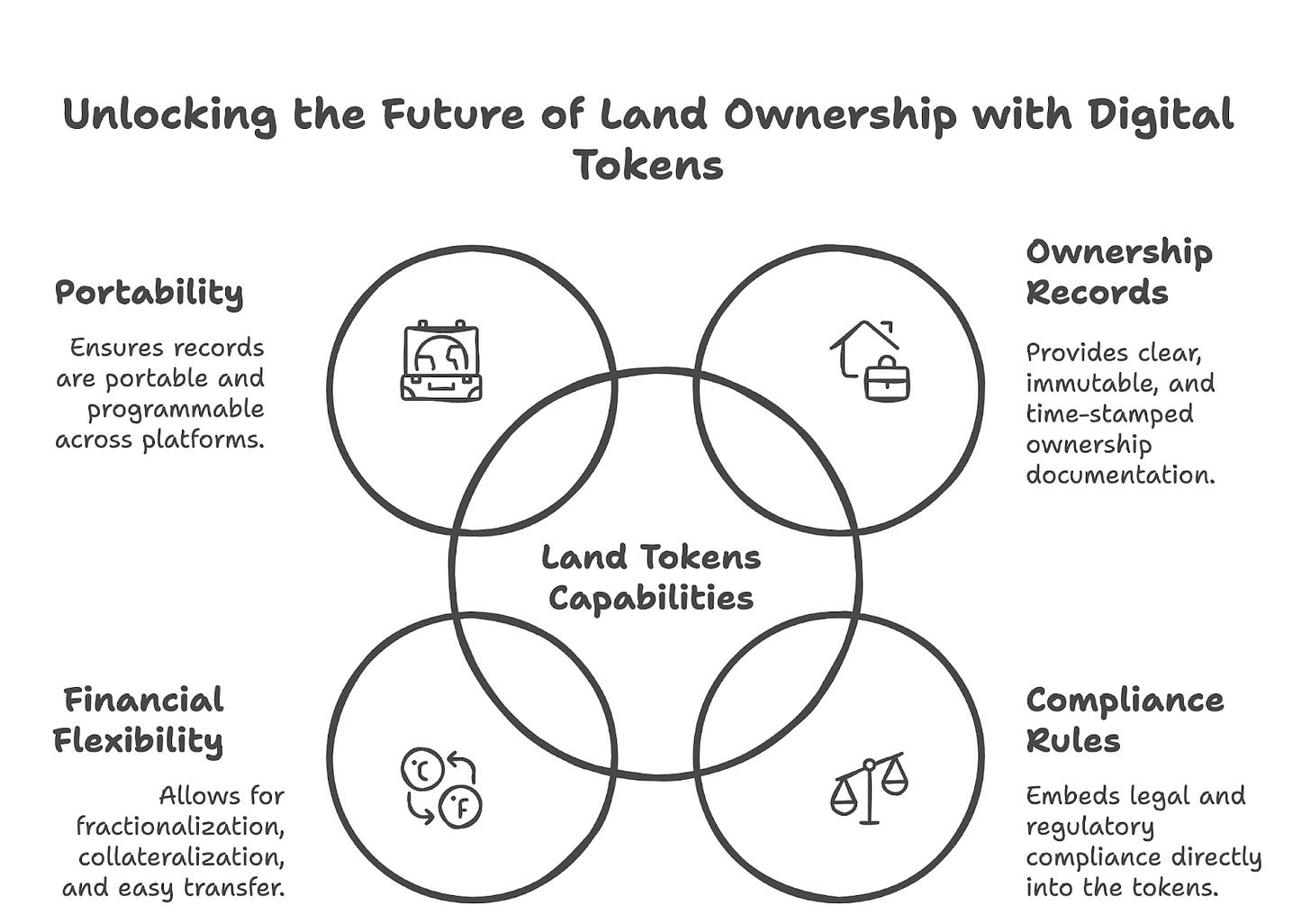

At its core, tokenization creates a verifiable digital representation of a physical asset. In this case, land. But the magic isn’t just in the digitization; it’s in what the token carries with it. Each token becomes a unit of trust, carrying verified data, embedded rules, and auditable trails that anyone can rely on without knowing the other party.

Suddenly, land isn't just a physical plot. It becomes a credentialed, interoperable financial asset that can be plugged into credit systems, supply chains, or even DeFi rails.

Tokenization turns trust into a system feature that is verifiable, programmable, and scalable, rather than something dependent on paperwork or personal reputation or what we as Indians love to term as ‘jugaad’!

What can this enable?

The implications here are huge. For rural landowners, especially small and marginal farmers, tokenization means they could finally unlock formal credit against land they’ve held for generations. No more obscure revenue documents or village officers’ signatures. For state governments, it can pave the way for more precise property taxation, simplified dispute resolution, and more intelligent planning. For startups, it means a new layer to build on, whether it’s tokenized leasing platforms, land-backed lending apps, newer property ownership models, or even crowdfunding marketplaces for idle plots.

Think of what UPI did to payments! By abstracting away complexity and embedding trust into the architecture, it enabled an explosion of use cases. Tokenized land could do the same for property, credit, and entrepreneurship.

What About Commons and Community Lands?

While most conversations on land reform focus on private ownership, some of India’s most pressing land conflicts lie elsewhere… in commons. From village grazing lands to forest rights, community-owned lands account for a significant portion of India’s terrain. Yet, they often suffer from ambiguous documentation, overlapping claims, and vulnerability to encroachments. In fact, by some estimates nearly 74% of land conflicts in India involve common lands, and many of them impact tribal or rural communities with deep historic ties to the land. Tokenization offers a way to bring clarity, consensus, and control to these contested spaces.

What if we could create tamper-proof digital records and clearly codify traditional or community-held rights? Land tokenization could reduce disputes, empower local governance structures, and protect against unauthorized grabs. In places like Pachgaon, Maharashtra, we’ve already seen what’s possible8. When the community secured formal rights over their bamboo forests, livelihoods transformed. Land tokenization could extend that trust across thousands of villages. It could unlock sustainable development projects like agrivoltaics (combining agriculture with renewable energy generation) and eco-tourism to carbon credit markets, where communities contract on their terms, with digital infrastructure that backs them.

It’s about recognizing that land is more than soil. It’s memory, meaning, and shared belonging to many communities. And giving communities the tools to protect and prosper from it might just be the unlock they’ve been waiting for.

What’s holding us back?

Needless to say, there are very real challenges to making this happen. For one, land is a state subject. That means implementation will be fragmented and adoption will depend heavily on state-level reform in the Indian context. This may include digitized records, clear title systems, and the creation of open, interoperable systems if it is to truly realize its potential.

Then there’s the legal dimension. How do we ensure that a digital token truly represents enforceable rights? What’s the process for resolving disputes or errors? Who’s the registrar of record? We must acknowledge that these are not trivial questions!

But the path forward is not unfamiliar. India already has the blueprints. We’ve seen it in Aadhaar, which provides citizens with robust biometric-based credentials. The Account Aggregator framework, which enables secure and consent-based data sharing. The GST Network, which standardizes tax records across the country. At the foundation of all these is the philosophy of building open, interoperable, population-scale digital infrastructure that serves as a public good. The real opportunity now lies in connecting all these elements together to create trusted and accessible token registries for land and property.

Why is this relevant now?

The talk is full of big, exciting ideas ranging from language AI to micro-entrepreneurship in tier-3 towns. But what makes land tokenization particularly powerful is that it touches every theme that he outlines.

In fact, tokenized land may be one of the few innovations that can simultaneously drive financial inclusion, economic productivity, and strengthened institutional trust.

Where Do We Go from Here?

The next phase of India’s growth story will not be built by code alone or through IPO filings. It will also depend on how we value, verify, and unlock one of our most foundational assets, i.e., land.

Land tokenization is not a silver bullet. It won’t solve every dispute or remove every barrier. But it offers a new foundation. One that can bring clarity where there is confusion, build trust where there is skepticism, and enable participation where there was exclusion. We already have the building blocks: digital identity, consent-driven data systems and scalable public infrastructure. Now the opportunity lies in connecting them to reimagine how land is recorded, accessed, and shared. Perhaps the Finternet (another one of Mr. Nilekani’s brainchilds) could play a central role here! But the potential seems clear… whether it’s enabling credit for small farmers, protecting community-held commons, or supporting new models of development, land tokenization can expand what’s possible!

If you enjoyed reading this blog and would like to receive more such articles from Scaling Trust, please subscribe to our blog using the link below:

Alternatively, know more about us on our website here.

Keep in touch with us on: LinkedIn | X | Telegram | Youtube | Email