Trust Through Time: From Barter to Digital Transactions

This blog explores the evolution of trust in commerce from personal exchanges and institutional frameworks to branding and digital platforms that shape global trade today.

TL;DR:

Trust in Early Commerce: Trust began in small communities through personal relationships and reputation, as seen in barter economies where exchanges relied heavily on familiarity and social standing.

Currency and Guilds: The introduction of currency and trade guilds helped scale trust beyond local communities by standardizing transactions and enforcing quality, allowing trade to expand across larger regions.

Corporate Branding: Modern corporations like Coca-Cola, Apple, and Unilever have scaled trust through consistent branding, ensuring consumers worldwide associate their products with reliability, quality, and ethical standards.

Digital Platforms: Platforms like Amazon and Airbnb have revolutionized trust by using system-generated mechanisms like ratings and reviews, enabling millions of transactions daily between strangers. However, challenges such as fake reviews and data privacy concerns persist.

Takeaway: Trust has evolved from personal exchanges to digital systems. The future of commerce will depend on how businesses merge traditional branding with digital trust mechanisms while addressing rising concerns over data integrity and privacy.

Do you remember those simpler days in school when you saved extra candies from your birthday to give to your best friend, hoping they would return the favour on their special day? This gesture wasn't merely about sweets—it symbolised a special bond built on trust. Reflecting on these childhood exchanges, from birthday treats to gifts, recalls the numerous instances of trust that defined early relationships.

These innocent childhood transactions mirror the fundamental role trust has played in commerce since the dawn of civilization. From these simple exchanges to today's complex global marketplace, trust has remained the invisible thread weaving the fabric of human interactions and business dealings.

Imagine the first traders, exchanging goods based solely on personal relationships and reputations. This foundational trust, once limited to small communities, has undergone a remarkable transformation over millennia. The journey from these intimate exchanges to our current global marketplace tells a compelling story of human adaptability.

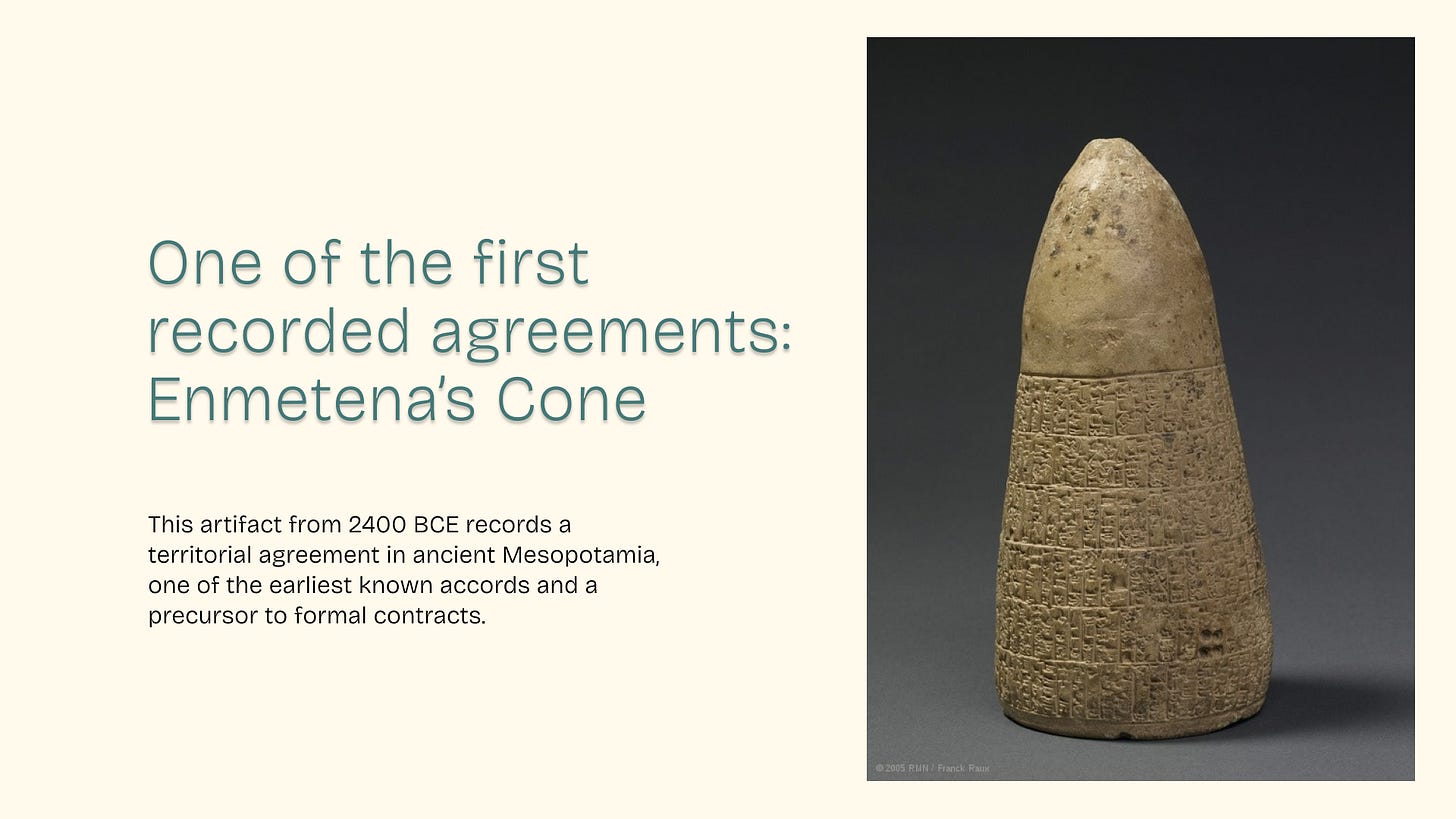

This evolution is well captured in artifacts like the 'Enmetena's Cone' from ancient Mesopotamia (circa 2400 BCE). This clay cone, documenting an agreement between city-states, marks a pivotal shift from verbal accords to written agreements, adding a new layer of accountability. It represents one of the earliest steps in the long road toward formalized trust mechanisms.

As we trace this journey in this article, we'll explore how trust transitioned from personal to institutional, and finally to digital forms. We'll examine how the invention of currency, the rise of trade guilds, the emergence of corporate branding, and the advent of digital platforms have each revolutionized the way trust operates in commerce. Throughout this evolution, one thing remains constant: trust continues to be the currency that oils the wheels of commerce, enabling businesses to scale from local markets to global enterprises.

The Early Days: When Reputation Was the Currency

In the barter economy, which dominated ancient commerce, trust was the backbone of all transactions. Without formalized trade systems or currency, people relied on interpersonal relationships, personal reputation, and repeated interactions to ensure fair exchanges. Trust was built through familiarity—participants knew each other personally, and their reputation in the community was crucial to their ability to trade. If someone failed to uphold their promises, they risked being ostracized, effectively cutting them off from future exchanges (Smithin, 2000).

However, the barter system imposed clear limitations on the scalability of trust. Trust was localized, confined to small, tight-knit communities where personal relationships could be easily monitored and reputations managed. This reliance on face-to-face interactions meant that trade could only happen within a relatively small circle of individuals who knew and trusted each other (Botsman, 2017). As a result, the economy remained limited in size and scope because trust could not extend beyond direct, personal interactions.

The absence of a formal legal system or written contracts further constrained scalability. Without institutional structures to enforce agreements, trust was fragile and bound by the proximity of personal relationships (Smithin, 2000). As commerce began to grow beyond local communities, it became evident that this form of trust, while effective at a small scale, could not support the larger, more complex networks of trade that were emerging.

Scalability was restricted, not because trust was absent, but because it could not stretch far beyond the individuals involved. This need for direct relationships limited economic growth and created a demand for more scalable systems of trust. Systems that could enable commerce between strangers across larger regions, ultimately paving the way for the invention of currency and other trust mechanisms that would allow economies to expand significantly (Smithin, 2000; Botsman, 2017).

While the limitations of the barter system underscored the need for a more scalable approach to trust, communities still sought ways to extend trustworthy exchanges beyond direct, personal relationships. This demand led to the development of informal yet sophisticated trust networks, such as the Hawala system. Emerging centuries ago, Hawala bridged the gap between localized, personal trust and the broader networks required by expanding commerce. By relying on interpersonal bonds but enabling transactions over vast distances, the Hawala system became an early solution to the challenges of scale, facilitating trade and remittances without relying on formalized legal structures. In this way, Hawala illustrates a unique middle ground—acting as both a personal trust network and a precursor to institutionalized systems.

1.1 Case Study: The Hawala System - The bridge between personal and institutional trust

As the need for wider-reaching trust networks grew, systems like Hawala demonstrated that trust could stretch beyond direct relationships without formal institutions. However, to fully support the demands of burgeoning trade networks, societies required even more scalable solutions. This led to the adoption of currency, a milestone that transformed the nature of commerce. Unlike Hawala, which relied on interpersonal bonds, currency introduced a standardized form of value that strangers could trust. This evolution laid the groundwork for the next stage in the journey of trust—the rise of currency and trade guilds, which would further standardize and institutionalize trust, facilitating exchanges across ever-larger distances and diverse communities.

The Transition to Currency and Trade Guilds: Standardizing Trust

We’ve explored how trust in trade has evolved from intimate exchanges to far-reaching institutional systems. In early barter economies, trust was a product of personal, face-to-face interactions, where individuals relied on close relationships to ensure the fulfillment of agreements. However, as commerce expanded, the limitations of barter became evident—a system confined by the scale of direct, personal relationships could not meet the needs of a growing economy. The demand for a scalable means to build trust across larger regions became clear.

The advent of currency marked a turning point in this journey. Precious metals like gold and silver, valued for their rarity and durability, emerged as universally accepted mediums of exchange (Smithin, 2000). This shift allowed traders to trust the intrinsic value of currency itself rather than relying solely on personal connections. With currency, merchants could now transact with strangers over vast distances, effectively scaling trust beyond the local community. State-backed coins, such as those issued in ancient Greece and Rome, further standardized trade, offering guarantees of weight and purity that facilitated reliable transactions across regions (Davies, 2002).

This shift from personal to institutional trust was revolutionary. Currency bridged the gap, enabling trust to extend beyond local networks and laying the foundation for sophisticated economic systems. It was this transition that set the stage for interregional trade networks, ultimately leading to the global economy we recognize today (Weatherford, 1997).

As trust mechanisms evolved from personal relationships to institutional frameworks, certain innovations emerged as critical turning points in expanding trust across larger territories. One early example of this shift was seen in the standardized coinage of Lydia, which set a precedent for trust in currency.

Case Study: The Lydian Coinage

In the 7th century BCE, Lydia, a prosperous city-state, pioneered standardized coinage by minting gold and silver coins stamped with the royal seal of the Lydian kings. These coins acted as guarantees of value, allowing merchants to trade without needing personal connections or extensive inspections of goods (Kroll, 2008). This innovation was transformative, as it enabled trust to scale beyond local communities, facilitating trade and economic collaboration across the Mediterranean among previously unconnected individuals.

Implication: The introduction of standardized coinage in Lydia expanded trust from localized communities to entire regions, establishing a foundation for the more complex economic interactions that would follow.

As currency established a foundation for trust beyond local communities, trade continued to grow, necessitating new forms of oversight to ensure consistent quality and fair practices. This need gave rise to trade guilds during the medieval period, which became essential for institutionalizing trust across expanding markets.

2.1 Medieval Period: Guilds and Institutional Trust

As trade continued to expand during the medieval period, the emergence of trade guilds became an essential mechanism for further scaling trust. Guilds regulated membership, prices, and product quality, providing institutional assurances that transcended personal relationships. Merchants could trust the quality and fairness of goods and services without knowing the provider directly, relying instead on the guild’s oversight (Botsman, 2017).

Guilds emerged as essential players in supporting long-distance trade by regulating member practices, setting prices, and enforcing product quality. These organizations became trusted arbiters of commerce, providing assurances that went beyond personal relationships. For merchants, guild membership became a mark of credibility, enabling them to trade with confidence even with unfamiliar parties. Guild oversight reduced the risks associated with distant transactions, allowing traders to rely on guild reputation rather than individual familiarity (Botsman, 2017). The collective standards enforced by guilds also made it easier for consumers to trust goods and services, contributing to a broader, more cohesive economic network.

Case Study: The Goldsmiths' Company

An exemplary case is the Goldsmiths’ Company of London, founded in the 12th century. The Company set rigorous standards for gold and silver purity, with its seal serving as a trusted quality guarantee (Forbes, 1999). This mark became widely recognized, enabling consumers to trust products based solely on the Company’s reputation. The Goldsmiths’ seal extended trust across regions, building confidence in transactions without the need for direct inspection. This model not only standardized the quality of traded goods but also protected buyers and sellers by providing a reliable system of accountability and quality control that operated independently of individual merchants.

Implication: By establishing enforceable, consistent standards, guilds allowed trust to scale across vast regions, enabling commerce to flourish in a more interconnected medieval economy. This structured approach to trust would become the backbone of broader trade networks and inspire later systems of institutional regulation.

The rise of institutions like guilds, along with currency, marked a pivotal step in the evolution of trust from personal relationships to broader, standardized frameworks. These early regulatory systems allowed commerce to move beyond localized exchanges, enabling trust to scale and setting the stage for increasingly complex and interconnected economic systems. These foundational developments paved the way for today’s intricate global economy, where institutions continue to play a central role in sustaining trust across vast networks (Smithin, 2000; Botsman, 2017).

As commerce evolved through early forms of currency and institutionalized trust within guilds, trade expanded far beyond local boundaries, creating a foundation for large-scale economies. These early mechanisms of trust provided the consistency and reliability needed for commerce to grow across regions, yet they still depended on physical interactions and recognizable affiliations. Entering the modern era, businesses faced a new challenge: how to foster trust on a truly global scale, where interactions were increasingly indirect and reliant on mass communication.

In response, modern corporations turned to branding as a powerful tool for scaling trust across vast geographical and cultural landscapes. No longer constrained by personal connections or institutional seals, companies could use their brand identity to communicate reliability, quality, and ethics worldwide. This marked a significant evolution from traditional trust mechanisms, with branding strategies now assuming roles once held by local currencies and guild oversight.

Modern Corporations and the Role of Branding in Scaling Trust

As commerce expanded from local markets to a global scale, the mechanisms for building trust transformed fundamentally. Once based on personal connections and institutional symbols, trust in the modern era required a system capable of crossing cultural and geographical boundaries. Branding became this crucial system, enabling corporations to communicate reliability, quality, and ethical standards to consumers worldwide.

It has been observed that modern commerce reflects a shift from “local, personal trust to distributed systems of trust” (Botsman, 2017). In this context, branding became essential in fostering trust on a large scale, allowing companies to offer a symbolic assurance that could replace the physical familiarity of early trade. Through consistent branding strategies, companies signal their commitment to quality and ethical practices, empowering consumers to trust them without direct interactions.

3.1 Case Studies

Implications

Consistent Trust Message: Strong branding establishes a uniform message that resonates internationally, building trust even in new or unfamiliar markets.

Enhanced Scalability: Companies with a reputation for reliability and ethical conduct, such as Unilever’s dedication to social responsibility and Apple’s focus on innovation, are better positioned to expand and introduce new products in diverse markets.

Halo Effect: Ethical consistency and transparency foster trust across all offerings, as seen with Unilever’s social initiatives and Apple’s commitment to user privacy.

Global Scalability: Brands like Apple demonstrate how strategic branding can scale trust internationally, boosting consumer confidence across products and regions.

Through these strategies, modern corporations have cultivated extensive networks of trust, enabling them to operate seamlessly across borders and diverse cultures. Yet, as branding has allowed corporations to build trust on a global scale, the digital revolution has introduced an even more transformative shift. As businesses and consumers increasingly interact through online platforms, trust has moved beyond brand assurances to technology-driven systems. In this new landscape, trust is no longer established solely through personal or corporate connections but is now shaped by digital mechanisms that facilitate interactions in unprecedented ways.

Digital Platforms: System-Generated Trust Mechanisms

The digital revolution has elevated trust-building to new heights through system-generated mechanisms like ratings, reviews, and digital reputations. This shift marks the emergence of "distributed trust," where trust flows laterally through expansive networks and platforms (Botsman, 2017). In this model, users rely on technology-mediated indicators, such as ratings and transaction histories, rather than on personal experiences or institutional assurances.

Leading platforms like Amazon, eBay, and Airbnb have embedded these digital trust mechanisms into their core business models. For example, Airbnb’s mutual rating system creates a digital trail that guides future decisions, replicating the reputation-based trust seen in early economies but on a global scale (Botsman, 2017). This ability to establish trust efficiently has fueled the growth of the sharing economy, enabling millions of daily transactions among individuals without any direct personal relationship.

Yet, the digital trust landscape brings its own set of challenges. Issues like fake reviews, data privacy concerns, and biases within algorithms threaten the reliability of these systems (Botsman, 2017). As digital trust mechanisms become integral to commerce, maintaining their integrity is essential, with global regulatory frameworks being considered to uphold credibility and guard against manipulation.

Trust remains a vital element in commerce, evolving from personal exchanges to institutional and corporate branding, and now to digital systems. Though methods for building trust have shifted, its fundamental role in commerce endures. Today’s transition to system-generated trust represents the latest chapter in the long-standing journey of trust in commerce.

What’s next?

The journey of trust, from intimate bartering exchanges to digital platforms, has mirrored society's growth and complexity. Each phase in this evolution—whether through local relationships, institutional frameworks, branding, or digital systems—has expanded the scope of trust, making it possible to connect with individuals and entities across vast distances and diverse contexts. Yet, as the digital landscape matures, the future of trust in commerce presents critical questions: How will businesses effectively blend traditional branding strategies with digital trust mechanisms to cultivate deeper, more resilient consumer relationships? As dependence on digital interactions intensifies, what measures will be needed to maintain integrity amid rising concerns over data privacy, algorithmic biases, and the authenticity of online reviews? Furthermore, as regulatory frameworks attempt to keep pace with these rapid changes, what role will they play in setting universal standards for trust in a global digital economy? Answering these questions will define the next era of commerce. With each innovation, trust remains central, adapting to new forms and settings. As we continue to navigate a complex digital world, the enduring importance of trust in enabling meaningful, reliable connections across the globe will shape the future of business and society alike.

References:

Botsman, R. (2017). Who Can You Trust?: How Technology Brought Us Together and Why It Might Drive Us Apart. PublicAffairs.

Davies, G. (2002). A History of Money: From Ancient Times to the Present Day. University of Wales Press.

Deloitte. (2020). Global Powers of Retailing 2020: Shifting Consumer Focus. Retrieved from [https://www2.deloitte.com].

Forbes, R. J. (1999). Studies in Ancient Technology: Volume V. Brill Archive.

Kroll, J. (2008). "Coinage and the Transformation of Greek Commerce." In W. V. Harris (Ed.), The Monetary Systems of the Greeks and Romans (pp. 12-22). Oxford University Press.

PwC. (2022). The Role of Purpose in Driving Brand Trust. Retrieved from [https://www.pwc.com].

Smithin, J. (2000). What Is Money? Routledge.

Weatherford, J. (1997). The History of Money. Three Rivers Press.

All artworks are designed by Yosha Waghela

If you enjoyed reading this blog and would like to receive more such articles from Scaling Trust, please subscribe our blog using the below link:

Alternatively, know more about us on our website here.

Keep in touch with us on: Linkedin | X | Telegram | Youtube | Email