Tokens: A look at the Coordination Tools Behind Social and Economic Systems

From ancient clay to digital code, tokens have powered human coordination by making the intangible tangible. Now, programmable tokens actively manage it, unlocking new coordination possibilities.

Think about how often we use tokens in our daily lives. Tapping a metro card, flashing an ID, scanning a QR code to pay for coffee, or redeeming a gift voucher online. They’re everywhere. But tokens are not just tools of convenience or containers of value. They are one of humanity’s oldest and most enduring tools for coordination.

From ancient clay tablets to today’s blockchain assets, tokens have helped us represent value, enforce obligations, and organize our interactions across vast distances and timelines. Long before money looked like the notes in your wallet or contracts were written in legal language, tokens allowed communities to make sense of complex social and economic relationships. They let us externalize meaning and turn intangible agreements into something concrete.

What makes tokens so powerful and persistent is their ability to simplify coordination problems. Whether it’s tracking who owns what, managing credit, allocating grain, or executing a contract among multiple parties, tokens turn abstract ideas into tangible, trackable units. They help codify who owes what to whom, who can access which resource, and when an agreement is valid.

Today, programmable tokens on digital platforms are not an entirely new invention. They are the most advanced iteration yet of a timeless idea. To truly appreciate their potential, we need to look back and understand what tokens have always been designed to solve.

So what exactly makes tokens great for coordination?

At their core, tokens help us structure interactions. They take complex, distributed, or time-sensitive problems and turn them into something we can manage. A token allows value, access, identity, or obligation to be symbolized in a form that can be stored, transferred, or acted upon.

That’s what makes them so versatile. They are not limited to finance. A passport is a token of identity and movement. A theatre ticket is a token of entitlement. A parking permit is a token of access. Even a handshake, in the right context, can act as a social token, signaling agreement.

The enduring nature of tokens lies in their ability to address the following key coordination challenges:

Representation: How do we represent value, rights, or identity in a portable and verifiable way? Tokens provide a tangible form that encapsulates these concepts, making them easier to understand and manage.

Transferability: How do we transfer that representation across people, places, or systems? Tokens facilitate the movement of value or rights, enabling seamless transactions and interactions in various contexts.

Enforcement: How do we enforce or constrain what that representation means, socially, legally, or technically? Tokens come with inherent rules and meanings that guide their use, ensuring that they are respected and upheld within their respective frameworks.

Tokens, in short, are how we make shared meaning operational.To fully grasp the significance of today’s digital tokens, let us step back and look at their long and layered history. This brings us to a long lineage of token innovation.

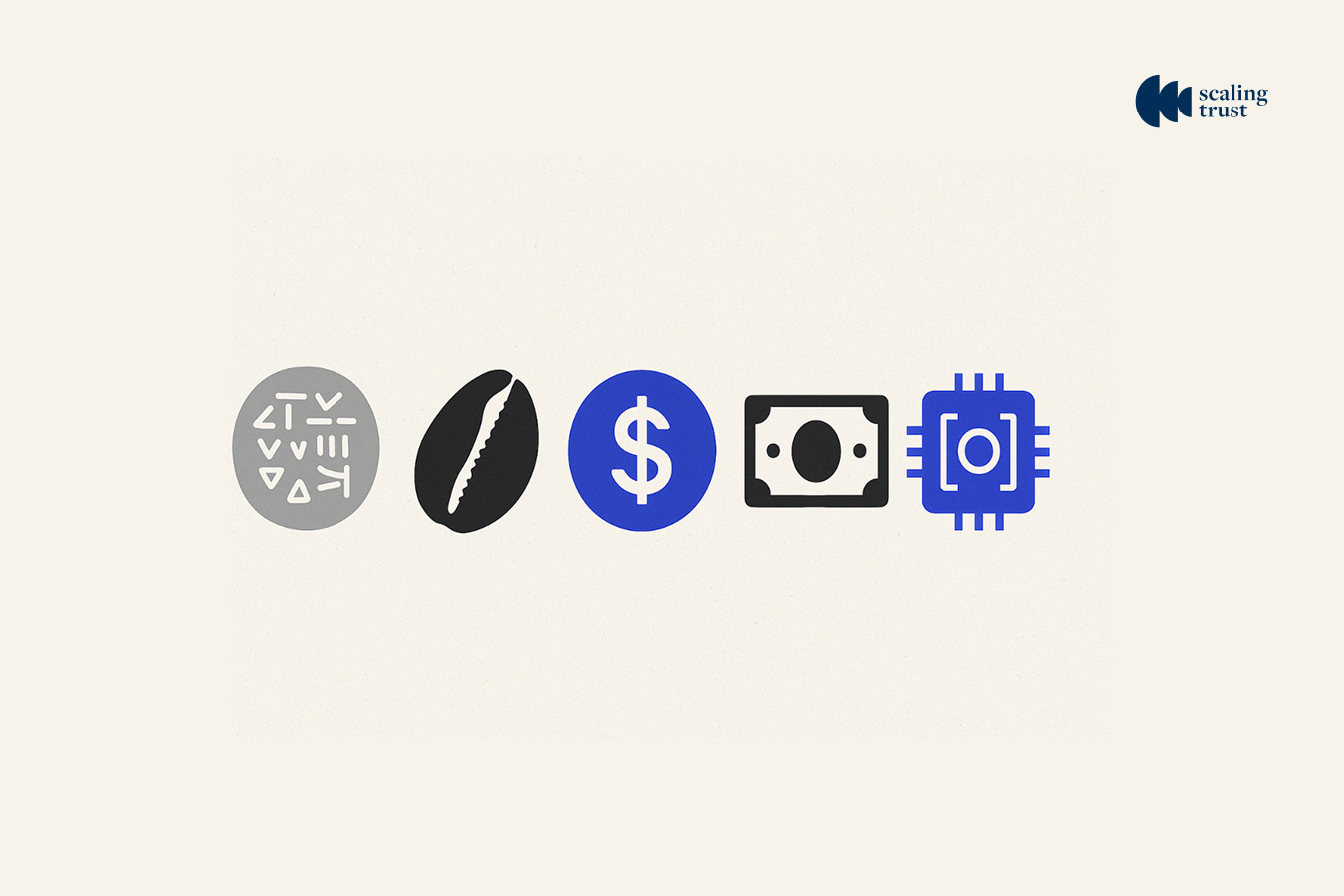

How has token innovation evolved throughout human history?

Tokens have taken many forms over time from clay pieces and shells to coins, paper, and now digital codes. But their purpose has remained constant: enabling coordination, accountability, and trust across distances and generations (Graeber, 2011).

Clay tokens enabled recordkeeping in agrarian societies (circa 7500 BCE): In ancient Mesopotamia, small clay objects represented quantities of goods like grain, oil, or livestock. These were stored in sealed clay envelopes, often marked,a precursor to contracts. Over time, their markings evolved into cuneiform writing (Schmandt-Besserat, 1996). These tokens helped structure economic activity and record obligations, even in the absence of the original parties. They were not money, but tools for memory and accountability, an early form of state infrastructure for logistics and taxation (Scott, 2017).

Commodity tokens enabled trustless exchange between strangers: As trade grew beyond local networks, societies adopted tokens that could carry value. Cowrie shells, metal blades, and salt bars served as widely accepted mediums of exchange. Their value came from intrinsic properties or shared recognition. They allowed strangers to transact, solving problems of fungibility and facilitating long-distance trade (Weatherford, 1997).

Coinage and paper enabled institutional standardization: With the rise of empires came more formal tokens. Roman coins bore state insignia. Renaissance-era bills of exchange allowed cross-border debt settlement. Later, banknotes represented institutional promises, backed first by gold, then by legal authority (Ferguson, 2008). These tokens did not hold value themselves but symbolized enforceable claims. Their strength came from institutional trust, enabling scalable and portable value systems (North, 1990).

Digital tokens introduced abstraction and fragmentation: In the 20th century, tokens became digital. Bank balances, transit passes, loyalty points, and mobile top-ups were stored on centralized ledgers, offering speed and convenience. But they were siloed. One of the more recent applications we may be familiar with is payment card tokenization, where sensitive card details are replaced with non-sensitive token equivalents during transactions (Murdoch & Anderson, 2014). This innovation protects the underlying financial information by ensuring it isn't directly shared with merchants or stored in their systems, significantly enhancing security while maintaining functionality (PCI Security Standards Council, 2011). Despite these benefits, digital tokens remained largely constrained by their environments. A bank deposit could not interact with a stock certificate, and systems lacked interoperability. Though efficient, these digital tokens remained inflexible, unable to operate seamlessly across platforms or encode their own conditions. Payment tokens, while revolutionary for security, still operated within closed ecosystems controlled by payment networks and financial institutions (Wang & Mainolfi, 2018).

The rise of programmable tokens: We are now entering a new era: tokens that are not just representations, but also agents. Powered by distributed ledgers and programmable infrastructure, today’s digital tokens don’t just say what they are, they know what they can do. A token can carry not just a value or right, but also the logic of its transfer, use, and enforcement.

This programmability of tokens manifests across multiple domains:

In finance, governance tokens on platforms like Compound and Uniswap grant voting rights proportional to holdings and execute decisions based on community votes without intermediaries (Schär, 2021).

In education, the Open Badges standard and platforms like Blockcerts enable verifiable digital credentials that can be independently verified across institutions without requiring central verification (Grech & Camilleri, 2017).

In healthcare, systems like MedRec and HealthVerity use tokenized consent records that give patients control over medical data access while maintaining comprehensive audit trails (Azaria et al., 2016).

Evolution of Token Representation

This evolution represents not just technological advancement but a fundamental shift in how we coordinate value, rights, and relationships across systems. While traditional tokens required institutional oversight and digital tokens improved efficiency within siloed platforms, programmable tokens create new possibilities for direct, conditional, and transparent coordination at scale.

Why Does This Matter?

Programmable tokens open new design spaces for structuring complex systems: financial markets, public registries, digital identity, supply chains, and more. They provide a new coordination layer, one that merges data, logic, ownership, and execution into a single unit.

Think about it: for the first time in history, we have tokens that don't just represent value, but can actively manage it according to predefined rules and conditions. This fundamentally changes what's possible when we coordinate at scale.

With this, tokens can:

Unlock fractional ownership and access to previously illiquid assets - allowing everyday people to own small pieces of things that were once available only to the wealthy

Automate compliance and settlement across jurisdictions - removing friction from global interactions that previously required armies of intermediaries

Enable real-time entitlements tied to real-world events or behavior - creating dynamic relationships between actions and outcomes.

Allow for new forms of programmable public infrastructure (e.g. subsidies, benefits, aid) - potentially revolutionizing how governments deliver services to citizens.

By reducing the reliance on manual processes and unwarranted gatekeepers, programmable tokens make it easier for multiple parties, including individuals, institutions, and machines to coordinate fairly, transparently, and efficiently. And as a natural byproduct of this design, trust can scale. Not because we eliminate the need for trust, but because we embed its structure, transparently and consistently, into how tokens behave.

The token hasn't changed. But now, it can do everything it was meant to.

Each generation reinvents the token in the language of its tools. Clay, metal, paper, digits, code. What remains constant is the underlying need to coordinate meaning, value, and action across a growing, diverse society. Tokens are not just financial tools. They are infrastructure for cooperation. They help us compress uncertainty, manage rights, and make promises tangible. And now, with programmable architecture, they are finally catching up to their full conceptual potential.

The idea of the token is eternal. We've just built better tools to express it.

References

Antonopoulos, A. M., & Wood, G. (2018). Mastering Ethereum: Building smart contracts and DApps. O'Reilly Media.

Azaria, A., Ekblaw, A., Vieira, T., & Lippman, A. (2016). MedRec: Using blockchain for medical data access and permission management. 2016 2nd International Conference on Open and Big Data, 25-30.

Ferguson, N. (2008). The ascent of money: A financial history of the world. Penguin Press.

Graeber, D. (2011). Debt: The first 5,000 years. Melville House.

Grech, A., & Camilleri, A. F. (2017). Blockchain in education. Publications Office of the European Union.

Maurer, B. (2015). How would you like to pay? How technology is changing the future of money. Duke University Press.

Murdoch, S. J., & Anderson, R. (2014). Security protocols and evidence: Where many payment systems fail. In Financial Cryptography and Data Security (pp. 21-32). Springer.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge University Press.

O'Mahony, D., Peirce, M., & Tewari, H. (2005). Electronic payment systems for e-commerce (2nd ed.). Artech House.

PCI Security Standards Council. (2011). Information supplement: PCI DSS tokenization guidelines. PCI Security Standards Council.

Schär, F. (2021). Decentralized finance: On blockchain- and smart contract-based financial markets. Federal Reserve Bank of St. Louis Review, 103(2), 153-174.

Schmandt-Besserat, D. (1996). How writing came about. University of Texas Press.

Scott, J. C. (2017). Against the grain: A deep history of the earliest states. Yale University Press.

Wang, Y., & Mainolfi, G. (2018). The impact of tokenization on customer-perceived value of credit card transactions. Journal of Financial Services Marketing, 23(1), 71-83.

Weatherford, J. (1997). The history of money: From sandstone to cyberspace. Crown Business.

All artworks are designed by Sanjivini Dwivedi

If you enjoyed reading this blog and would like to receive more such articles from Scaling Trust, please subscribe to our blog using the link below:

Alternatively, know more about us on our website here.

Keep in touch with us on: LinkedIn | X | Telegram | Youtube | Email