Convenience at a Cost: The Twin Faces of Hyperconnected Finance — Ease and Cyber Risk

Written by Siby Christopher

TLDR - Key Takeaways:

Global Digital Payment Growth with Rising Fraud Risks: Digital platforms like UPI in India (over 7 billion monthly transactions), Brazil's Pix, and Mexico’s systems have greatly increased financial access. However, this surge brings new risks: online fraud in India rose 708% in two years, Brazilian consumers lost over $247 million to scams in 2022, and U.S. losses to online scams reached $8.8 billion. These trends underline the urgent need for security enhancements.

Instant Convenience, Instant Risks: Hyperconnectivity offers seamless transactions but creates vulnerabilities, with rapid cyber threats that many users remain unaware of, highlighting a critical need for better education on digital risks.

Analog vs. Digital Era Trade-Off: The Analog Era’s in-person transactions fostered trust but limited speed. The Digital Era offers instant global reach but also significantly increases exposure to cyber fraud, showing a trade-off between convenience and security.

Bridging Awareness and Regulation Gaps: Digital adoption outpaces regulatory frameworks, leaving users exposed. Improved regulation and awareness are essential to protect users and maintain trust.

From Institutions to Platforms: The Evolution of Financial Transactions

The history of financial transactions is as much a story of societal evolution as it is of technological advancement. In the Analog (Institutional) Era, trust in financial transactions was forged within physical walls, built on face-to-face interactions and safeguarded by established institutions like banks and credit unions. Transactions were deliberate, bound by geography, and took time to process—factors that, while limiting speed, anchored financial exchanges in human connection and institutional credibility. The emphasis was on slow, secure, and verified exchanges, which shaped the foundation of trust for generations.

In contrast, the Digital (Platforms) Era marks a dramatic shift, one where the physical barriers of institutions dissolve, and transactions transcend borders, happening instantly on digital platforms. Systems like India’s Unified Payments Interface (UPI) and global networks like Visa and Mastercard are not just channels for transactions—they are engines of accessibility, inclusivity, and unparalleled convenience. Today, financial services are within reach of anyone with a mobile device, allowing people to conduct transactions at the touch of a button. This unprecedented ease has democratized access to finance, integrating millions into the global economy who were previously excluded by the limitations of traditional institutions.

However, with this progress comes complexity. The migration to digital platforms has introduced new paradigms of trust and risk. Unlike the Analog Era, where trust was personal and institutionally anchored, the Digital Era places trust in the hands of automated systems, algorithms, and complex security protocols. And while these platforms promise convenience, they also expose users to new vulnerabilities, as reflected in the staggering 400% increase in online banking fraud over the last decade. In this new landscape, where transactions are as easy as sending a message, the age-old question remains: How do we build and sustain trust?

This four-part series explores the intricate journey from institutions to platforms and examines how the digital age has redefined trust in finance. Each part will delve into a unique aspect of this transformation:

Overview of the Digital Hyper-Growth

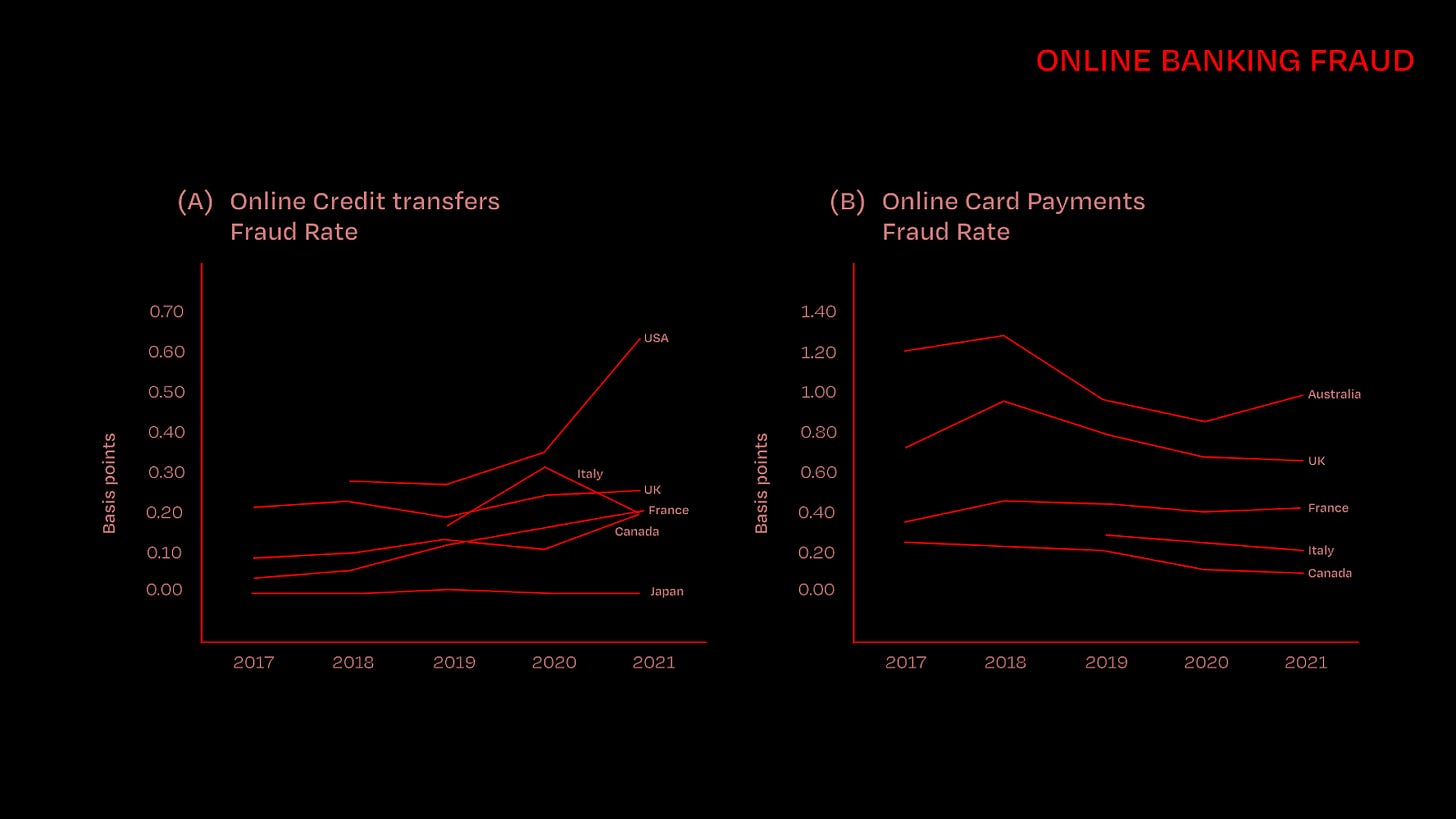

Over the last decade, the number of digital transactions has surged. According to recent data, there has been a significant increase in the number and value of credit transfers and card transactions across various regions.

By 2023, transaction volumes were 61% higher than forecast, while transaction values were 35% higher than forecast

This growth highlights the transformative impact of digital payments on everyday life, making transactions faster and more convenient.

The Transformation of Financial Transactions Through Digital Innovation

Before digital platforms, financial transactions were bound by the limitations of traditional institutions. Physical money, paper records, and in-person exchanges meant that transactions were slow, labor-intensive, and limited in scale. Banks set the pace, and access to services like credit was often restricted, requiring time, effort, and physical presence for each transaction. This traditional setup, while reliable, constrained financial inclusion and economic growth, especially across borders.

With the rise of digital platforms like UPI, Visa, and Mastercard, these limitations began to dissolve. Technology has transformed the world into an interconnected, instant-access civilization, enabling people to live and transact in a hyperconnected manner from any point on the globe, 24/7. This shift has unlocked unprecedented possibilities for financial inclusion, allowing users to access services in real time and fostering greater global integration. Digital platforms now serve as the backbone of this transformation, making financial services, information, and communication more accessible and efficient than ever.

However, this same hyperconnectivity that provides convenience also brings significant risks. Despite robust security measures, digital platforms inherently create opportunities for bad actors. Their capacity for instant, remote connectivity inadvertently opens new pathways for cybercriminals, who can exploit these systems with ease and minimal friction. While digital platforms offer seamless access to services, they simultaneously expose users to cyber threats at an equally rapid pace, creating a paradox where convenience and vulnerability coexist.

Digital platforms like UPI in India (over 7 billion monthly transactions), Brazil's Pix, and Mexico’s systems have greatly increased financial access. However, this surge brings new risks: online fraud in India rose 708% in two years, Brazilian consumers lost over $247 million to scams in 2022, and U.S. losses to online scams reached $8.8 billion. These trends underline the urgent need for security enhancements.

By balancing connectivity with security, we can work towards a resilient digital ecosystem that maximizes benefits without compromising trust.

The above figures give insights into the acute rise of activities pertinent to financial fraud over the years as the trend shows that this is synchronous to the rise in digitization.

Analytical Framework for Balancing Digitalization Benefits and Mitigating Digital Fraud Risks

Policymakers must balance the benefits of technological advancements in banking with the need to mitigate digital fraud risks through effective safeguards. The below figure gives the risk benefits analysis insights.

In the image, the upward arrow represents the current state of digitalization, where increased digital benefits often come with higher fraud risks. Regulators aim to shift this balance to the right, achieving more digital benefits with fewer fraud risks. However, it’s important to remember that regulators can’t fully control how quickly people adopt digital technology.

Key Points:

High Digital Adoption (Point A – "Wild West"): With a high level of digitalization, there are many benefits, but fraud risks are also very high.

Low Digital Adoption (Point B – "Stability of the Graveyard"): A low level of digitalization reduces fraud risks but also limits the potential benefits of digital finance.

Middle Ground (Point C – "Balancing Act"): This is an ideal point where digitalization brings benefits without excessive fraud risks.

The goal is to reach Point D, where the benefits of digitalization are maximized, but fraud risks are kept as low as possible.

Conclusion

In conclusion, the shift from the Analog (Institutional) Era to Digital Platforms has redefined financial transactions, offering unparalleled speed, global reach, and efficiency. These advancements have made financial services more accessible, allowing transactions to cross borders instantly and seamlessly. However, this new digital landscape brings an inherent trade-off: while it enables unprecedented convenience, it also introduces equally rapid risks. Unlike the slower-paced, geographically contained nature of analog systems, today’s hyperconnected infrastructure means that vulnerabilities can propagate globally, potentially disrupting markets, destabilizing institutions, and even posing national security risks.

The 2016 Bangladesh Bank heist and the 2021 Colonial Pipeline ransomware attack illustrate how weaknesses in a hyperconnected digital ecosystem can have far-reaching consequences. In both cases, cybercriminals exploited digital systems to target critical infrastructure, revealing blindspots that impact entire financial and economic networks. These incidents underscore the critical need for more robust cybersecurity strategies, adaptive regulatory frameworks, and heightened vigilance to safeguard the global financial landscape. The balance between speed and security is delicate, and as digital systems continue to evolve, proactive risk management and layered security measures are essential.

However, securing digital systems isn’t just about technology; it’s also about awareness. The transition to digital platforms has brought hidden vulnerabilities that many users and institutions remain unaware of, creating blindspots in understanding the full spectrum of risks that accompany digital convenience. This lack of awareness leads to a false sense of security, where users may assume that platforms are inherently safe. This series aims to shed light on these trade-offs and highlight the complex realities of a hyperconnected digital economy, where convenience often comes at the cost of security and privacy.

In the next article, we will delve deeper into the factors that make digital platforms fertile ground for cybercriminals. From digital anonymity and global reach to complex, non-transparent contracts and inconsistent regulations across regions, these enablers provide new opportunities for bad actors. By identifying and addressing these dynamics, we can improve awareness and take concrete steps toward a resilient, trustworthy digital ecosystem that balances innovation with necessary safeguards.

References:

Bank for International Settlements (2024). Understanding Its Role in Global Finance. SuperMoney.

Basel Committee on Banking Supervision (2023). Digital Fraud and Banking: Supervisory and Financial Stability Implications. Bank for International Settlements

Crouch, J., Lothian, N., & von Weizsäcker, E. (2023). The design of data governance systems. Journal of Data Protection and Privacy

Doerr, S., Frost, J., Gambacorta, L., & Shreeti, V. (2023). Big techs in finance. BIS Working Papers No. WP1129. Monetary and Economic Department, Bank for International Settlements.

All artworks are designed by Yosha Waghela.

If you enjoyed reading this blog and would like to receive more such articles from Scaling Trust, please subscribe our blog using the below link:

Alternatively, know more about us on our website here.

Keep in touch with us on: Linkedin | X | Telegram | Youtube | Email