Building Trust in Fintech: Lessons from Square, PayPal, and Stripe

Written by Bertrand Kwibuka

TL;DR – Key Takeaways:

Importance of Trust: Trust is foundational for fintech, affecting relationships with customers and stakeholders.

Trust Dilemma: Fintech companies must address concerns about security and the complexity of digital transactions to gain user confidence.

Square's Approach: Simplified payment processing through user-friendly hardware and transparent pricing has empowered small businesses.

PayPal's Strategy: Enhanced security measures, including fraud prevention and buyer protection, have established user trust in online payments.

Stripe's Focus: Streamlined integration and transparent pricing for businesses have made online payments more accessible and trustworthy.

Key Strategies for Trust: User-centric design, transparent pricing, integrated services, robust security, simplified integration, and responsive support are crucial for building lasting trust in fintech.

Imagine for a moment that you're a small business owner in the early 2000s. You've just set up shop, and you're excited to start selling. But there's a problem: accepting card payments is expensive and complicated. You're stuck in a cash-only world, watching potential customers walk away because they can't use their cards. This was the reality for millions of small businesses before the fintech revolution.

Now, fast forward to today. You can accept payments with a simple device plugged into your smartphone, send money across the globe with a few taps, or even trade cryptocurrencies from your couch. But with these new possibilities come new challenges. How do we trust these digital platforms with our hard-earned money? How do we know our data is safe? This is the trust dilemma that fintech companies must solve.

Throughout history, from the ancient Roman banking houses to the modern digital wallets, trust has been the cornerstone of financial innovation. Today, as we stand at the cutting edge of the fintech revolution, the importance of trust has never been greater. Let's look at three companies that have done just that, each in their unique way.

Case 1: Square - Payment Process

In 2009, Square revolutionized card payments by making it accessible to everyone, especially small businesses. At a time when accepting card payments required expensive hardware and hidden fees, Square introduced a simple point-of-sale system using a small card reader that plugged into smartphones. This democratized payment processing for millions of small business owners.

Square faced several challenges. Traditional payment systems were like fortresses - secure, but hard to access. Small businesses were left out in the cold, unable to afford the high costs and complex systems required to accept card payments. The financial burden of traditional payment systems made it difficult for small businesses to participate, affecting their growth and market reach. Legacy systems were cumbersome, requiring hefty upfront investments in specialized hardware and software and a steep learning curve for users. Many small businesses had to resort to cash-only operations, losing potential customers who preferred card payments.

Square implemented several strategies to overcome these challenges and enhance trust in the process:

User-Friendly Hardware: Square designed a tiny card reader that could plug into a smartphone, turning any device into a point-of-sale system. This was like giving small businesses a key to the fortress. Square's hardware was designed with a focus on user experience, ensuring that it was easy to use and set up. This approach streamlined the onboarding process for businesses and enhanced customer satisfaction.

Seamless Integration with Smartphones: The integration of Square's hardware with smartphones allowed for a seamless and convenient payment experience for both merchants and customers. This integration leveraged the widespread use of smartphones, making it accessible to a broader audience.

Transparent Pricing Structure: In an industry known for hidden fees, Square introduced a flat-rate fee structure. This was akin to shining a light into the dark corners of financial services. Square's adoption of a transparent pricing structure with a flat-rate fee was a game-changer in the industry. By eliminating hidden costs and offering a predictable fee structure, businesses could budget more effectively, leading to increased trust and satisfaction.

Additional Services Beyond Payment Processing: Square didn't stop at payments. They built an ecosystem of services becoming a one-stop-shop for entrepreneurs. By integrating services such as inventory management, analytics, and loans, Square became a comprehensive solution provider for businesses, adding value beyond just processing payments. This strategic expansion broadened Square's appeal and strengthened its position in the market.

As a result, Square achieved significant market penetration, boasting over 4 million sellers using its platform by 2023. They reported $4.68 billion in revenue in Q2 2021—a 143% year-over-year increase. Square also expanded its ecosystem to offer an array of services, from payroll to cryptocurrency trading, through its Cash App (Nasdaq, 2021).

The key learnings from Square’s case to leverage their improvements and enhance trust are threefold:

Simplicity is key: Square’s user-centric design proved that simplifying complex processes can open new markets and encourage adoption.

Offering integrated services can foster customer loyalty and increase their lifetime value.

A clear straightforward fee structure can differentiate a fintech solution in a market known for its opaqueness.

Square's success shows us that simplicity and transparency can be powerful tools for building trust. By democratizing access to financial services, they've empowered millions of small businesses to compete in the digital age.

Case 2: PayPal - Pioneering Secure Online Payments

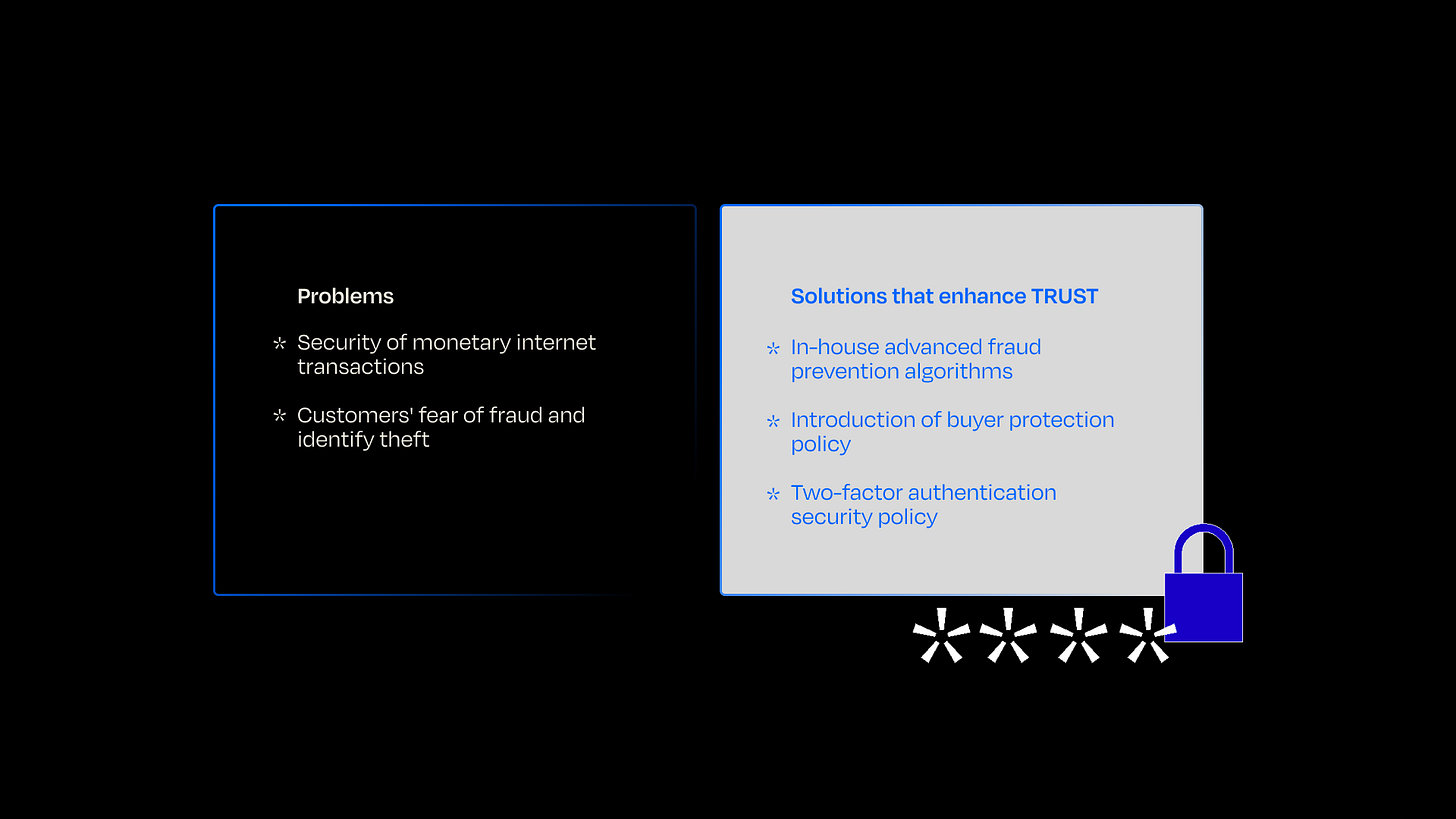

Cast your mind back to 1998. The idea of sending money online seemed as risky as sending cash through the mail. Users feared fraud and identity theft, as e-commerce was still in its infancy.

To address these concerns and enhance trust in the overall process, PayPal implemented several strategies, including the following key ones:

Developed advanced fraud prevention algorithms: PayPal created sophisticated algorithms to detect and prevent suspicious activities. This proactive approach reassured users that PayPal was actively working to protect their financial information.

Introduced buyer protection: PayPal promised to reimburse customers for transactions that did not go as planned. This buyer protection policy gave users confidence that PayPal would stand by them in case of any issues.

Implemented two-factor authentication: By becoming one of the first online payment platforms to implement two-factor authentication, PayPal added an extra layer of security to user accounts. This made it harder for unauthorized users to gain access to accounts, thereby enhancing trust.

Due to the important steps taken to further enhance trust, these strategies paid off. By 2023, PayPal had over 400 million active users and processed over $1 trillion in payments annually (Techreport, 2023). Their success afterwards demonstrates the power of prioritizing security and customer protection in building trust.

The key learnings from PayPal’s ambition and strategies to improve financial transaction security include:

Prioritizing security is essential in the digital age: PayPal’s investment in fraud prevention algorithms ensures that users feel protected when making online transactions.

Buyer protection builds long-term user trust: PayPal’s buyer protection policies reassure users that they will be refunded in case of issues, increasing trust and loyalty.

Advanced fraud prevention measures reassure users: By implementing sophisticated fraud detection tools and two-factor authentication, PayPal ensures that users’ financial information remains secure, fostering long-term trust.

PayPal's success demonstrates that in the digital age, security is paramount. By prioritizing user protection, they've built a platform that millions trust with their financial transactions every day.

Case 3: Stripe - Business Online Payments

In 2010, as e-commerce was booming, two young Irish entrepreneurs, Patrick and John Collison, saw a gap in the market. Online businesses needed a simpler way to accept payments. Thus, Stripe was born to make it easier for businesses to accept payments online. However, they faced trust issues due to the complexity and perceived risk of handling online payments (CB Insights, 2021). While PayPal had made consumer-to-business payments easier, business-to-business online payments were still complex and risky. Many businesses were struggling to navigate the technical and regulatory challenges of online payments.

Stripe addressed these concerns by focusing on simplicity and transparency. Stripe implemented the following strategies to enhance trust:

Developed a simple, easy-to-integrate API: Stripe created an API that allowed businesses to start accepting payments quickly. This simplicity reduced the perceived risk and complexity of handling online payments.

Adopted a transparent pricing model: Stripe’s pricing model had no hidden fees, making it easier for businesses to predict their costs. This transparency helped build trust among Stripe’s users.

Developed Stripe Identity: Stripe Identity is a tool that helps businesses prevent fraud and meet regulatory obligations. By developing this tool, Stripe demonstrated its commitment to security and trust-building.

The key learnings from Stripe's approach to simplifying online payments and enhancing security include:

Simplified integration attracts developers and businesses: Stripe’s easy-to-integrate API allows businesses to quickly adopt its payment system, reducing technical barriers and making it a go-to choice for developers.

Transparency reduces complexity and enhances trust: Stripe’s clear pricing model with no hidden fees helps businesses plan their expenses, enhancing trust and reducing the complexity of managing finances.

Adding security tools builds confidence in digital payments: Stripe's security features, like Stripe Identity, reassure businesses that their transactions are safe, helping to meet regulatory standards and build customer confidence.

As a result, Stripe has grown rapidly, processing hundreds of billions of dollars in payments annually by 2023 (CB Insights, 2021). Their success underscores the importance of simplicity and transparency in building trust.

Key takeaway strategies for fintech to enhance trust:

Building and maintaining trust is paramount for fintech companies operating in a highly competitive and rapidly evolving market. The success stories of Square, PayPal, and Stripe provide valuable insights into effective trust-enhancing strategies.

User-Centric Design: Ensuring that products and services are intuitive and easy to use can significantly enhance customer satisfaction and loyalty. For instance, Square’s user-friendly hardware and seamless integration with smartphones eliminated the barriers small businesses faced with traditional payment systems, encouraging widespread adoption and trust.

Transparent Pricing Structures: Clear and straightforward pricing models eliminate confusion and build credibility. Both Square and Stripe implemented flat-rate fee structures, which not only simplified financial planning for businesses but also distinguished their offerings in a market often criticized for opaque fee structures. This transparency fosters trust by aligning company interests with customer needs.

Integrated and simple services: Offering a suite of complementary services can create a more holistic value proposition, fostering deeper customer relationships. Square’s expansion into inventory management, analytics, and loans, and PayPal’s buyer protection and fraud prevention initiatives, illustrate how additional services can enhance the overall user experience and reinforce trust.

Robust Security Measures: Prioritizing security is crucial in the fintech sector, where concerns about fraud and data breaches are prevalent. PayPal’s implementation of advanced fraud prevention algorithms and two-factor authentication set new industry standards, reassuring users about the safety of their financial information. Similarly, Stripe’s development of Stripe Identity demonstrates a commitment to protecting businesses from fraud and meeting regulatory requirements.

Responsive Customer Support: Providing timely and effective customer support can address issues swiftly and reinforce trust. Fintech companies must ensure that users feel supported and valued, particularly when navigating complex financial processes or encountering problems.

With these strategies, fintech companies can build and sustain trust, differentiating themselves in a crowded marketplace. Emphasizing user-centric design, transparency, security, integrated services, simplified integration, and responsive support not only meets the immediate needs of customers but also positions fintech firms for long-term success and loyalty.

Comparative Analysis: Square vs. PayPal vs. Stripe

The Road Ahead: Building Trust in the Future of Finance

As we look to the future, new challenges are emerging. The rise of cryptocurrencies, the growing threat of cybercrime, and the increasing complexity of financial regulations all present new trust hurdles for fintech companies to overcome.

But if the stories of Square, PayPal, and Stripe teach us anything, it's that where there's a challenge, there's also an opportunity. The companies that will succeed in the future of finance will be those that can adapt to these new realities while staying true to the fundamental principles of trust-building: transparency, security, simplicity, and providing excellent customer service to address issues quickly and effectively.

References:

Business of Apps. (2024). PayPal Revenue and Usage Statistics (2024).

CapitalOneShopping. (2024). Paypal Statistics (2024): Users, Market Share & Transaction Data.

CB Insights. (2021). Stripe Teardown: How The $36B Payments Company Is Supercharging Online Retail.

CodeInterview. (2023). How Paypal leads the way in innovation after 20 years.

DigitalDefynd. (2024). Top 15 FinTech Case Studies [A Detailed Exploration] [2024].

Fortunly. (2023). How Many People Use PayPal+ PayPal Statistics for 2024.

Investor’s Business Daily. (2024). How Square Aims To Expand Cash App Into Consumer Banking Services.

Nasdaq. (2021). Square (SQ) Q2 Earnings Beat Estimates, Revenues Rise Y/Y.

Techreport. (2023). PayPal User Statistics: How Many People Use PayPal in 2023?

The Motley Fool. (2021). Will Square Be Worth More Than PayPal by 2025?

VatorNews. (2018). When PayPal was young: the early years.

Yahoo Finance. (2021). Square (SQ) Q2 Earnings Beat Estimates, Revenues Rise Y/Y.

All artworks are designed by Yosha Waghela.

If you enjoyed reading this blog and would like to receive more such articles from Scaling Trust, please subscribe our blog using the below link:

Alternatively, know more about us on our website here.

Keep in touch with us on: Linkedin | X | Telegram | Youtube | Email